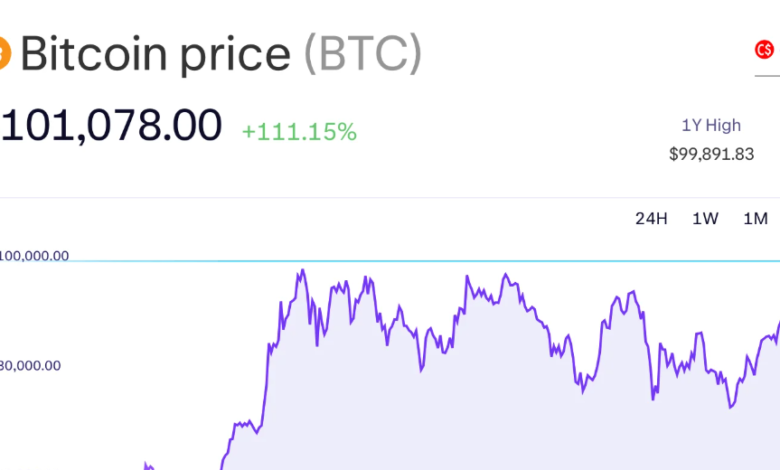

Bitcoin Price CAD and Canadian Investor Sentiment

Investor sentiment plays a major role in shaping the bitcoin price CAD. In Canada, emotions such as optimism, fear, and uncertainty often influence how Bitcoin is bought and sold, sometimes just as strongly as economic fundamentals.

Understanding this relationship helps investors recognize why price movements don’t always follow logical patterns.

What Is Investor Sentiment?

Investor sentiment reflects how people feel about the market. Positive sentiment encourages buying, while negative sentiment leads to selling or hesitation. In the crypto market, sentiment can shift rapidly due to news, social discussions, and sudden price movements.

These emotional responses directly affect the bitcoin price CAD.

How Sentiment Impacts Bitcoin Price in Canada

When Canadian investors feel confident, buying pressure increases, pushing prices higher. When fear enters the market—often during sharp declines—selling accelerates, causing prices to drop quickly.

Because Bitcoin trades continuously, sentiment-driven moves can happen at any time.

The Role of Media and Market Noise

News headlines, rumors, and social media discussions can amplify sentiment. Positive narratives often attract new investors, while negative stories can trigger panic selling.

These reactions may cause short-term spikes or drops in the bitcoin price CAD, even without major changes in fundamentals.

Fear and Greed Cycles

Bitcoin markets frequently move through cycles of fear and greed. During periods of rapid price growth, greed may lead investors to buy at high levels. During downturns, fear may push them to sell at a loss.

Recognizing these cycles helps investors avoid emotional decisions.

Managing Emotion as a Canadian Investor

To reduce the impact of sentiment:

- Focus on long-term goals

- Avoid constant price checking

- Use structured investment strategies

- Stick to a clear plan

Emotional discipline is often more important than perfect market timing.

Conclusion

Investor sentiment is a powerful force behind the bitcoin price CAD. By understanding how emotions influence market behavior, Canadian investors can stay calm, make better decisions, and navigate Bitcoin’s volatility more effectively.